|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring the Best CRM for Investors: A Comprehensive GuideIn the bustling world of investment, where every second counts and every detail matters, choosing the right Customer Relationship Management (CRM) system can be a game-changer. As investors navigate through an ocean of financial data, market trends, and client interactions, a robust CRM can act as a lighthouse, guiding them toward informed decisions and strategic growth. First and foremost, it's crucial to understand what makes a CRM effective for investors. The primary goal is to streamline and enhance communication with clients, while also organizing data in a way that is easily accessible and actionable. A good CRM will not only save time but also help in building stronger relationships with clients, offering insights into their preferences and behaviors. Key Features to Look for include:

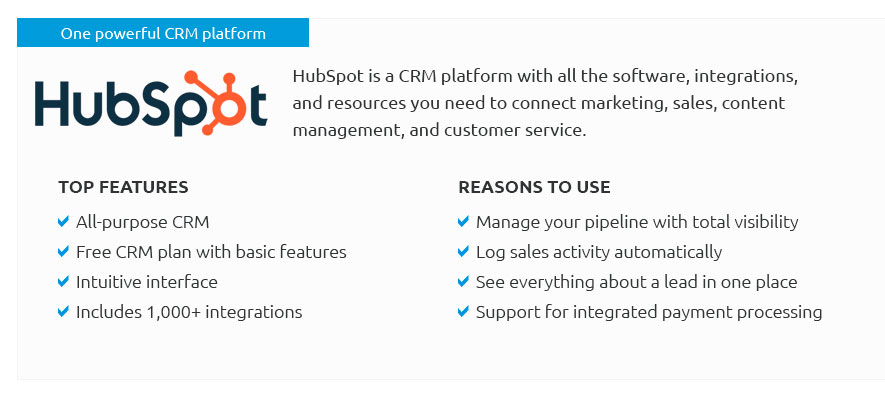

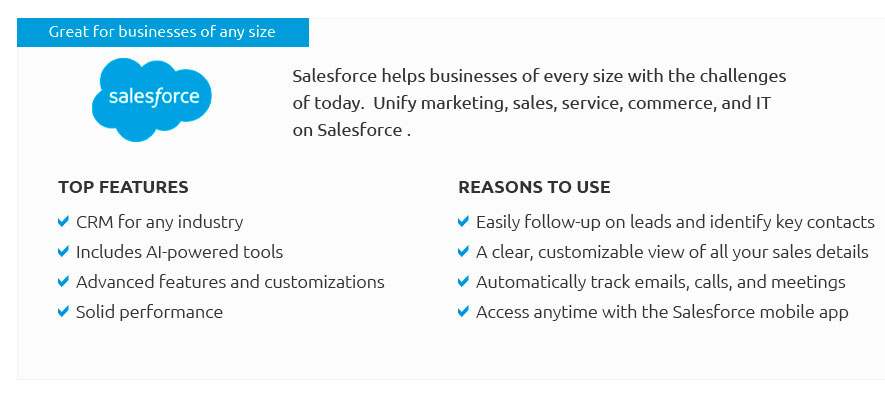

Among the myriad options available, Salesforce Financial Services Cloud often emerges as a top contender. Known for its versatility and powerful features, it caters specifically to the needs of financial advisors and investors. Its ability to integrate with a wide range of applications and provide deep insights into client portfolios makes it a favorite among industry professionals. However, for those seeking a more cost-effective solution, Zoho CRM is worth considering. It offers a broad array of features at a fraction of the price of its competitors, making it an attractive option for smaller investment firms or independent advisors. Meanwhile, HubSpot CRM is renowned for its exceptional user interface and strong emphasis on inbound marketing. It's particularly beneficial for investors who are looking to enhance their marketing strategies alongside managing client relationships. Its free version is surprisingly robust, allowing users to get a feel for the platform before committing to paid features. In conclusion, selecting the best CRM for investors hinges on individual business needs, budget constraints, and desired features. It's essential to thoroughly assess each option, perhaps even taking advantage of free trials to gauge how well they align with your operational workflow. Ultimately, the right CRM will not only simplify day-to-day tasks but also play a pivotal role in driving long-term growth and success in the investment realm. With a clear understanding of what to look for and a discerning eye, investors can make a choice that will serve them well into the future. https://setshape.com/blog/best-crm-for-investor-relations

We have done extensive research into the market to bring you the pricing plans, pros, cons, and features for 9 of the best CRM for investor relations in 2024. https://www.reddit.com/r/CRM/comments/1i6msec/best_crm_for_investment_fund/

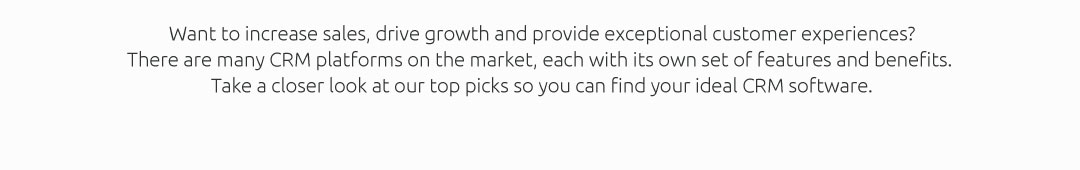

I'd recommend Pipedrive because it's simple, affordable, and perfect for small teams, with features like LinkedIn integration, automated follow- ... https://dialllog.co/crm-for-investor-relations

Investor relations CRM is a management software that allows one to manage relationships with potential or existing investors in a fund.

|